Latest news

£250,000 Second charge loan

Our team of commercial finance experts were able to secure terms with a challenger bank who offered 60% LTV against a purchase price of £2m, at a rate of 3.12% plus BBR.

The power of flexible bridging finance

Our team of commercial finance experts were able to secure terms with a challenger bank who offered 60% LTV against a purchase price of £2m, at a rate of 3.12% plus BBR.

Brightstar News

Semi-exclusive owner occupier & expat buy-to-let products

Owner Occupier Key Features: Rates from 5.74% Up to 80% LTV 2 & 5 year fixed £500 cashback towards legal costs for remortgages Expat Buy-to-let Key Features: Rates from 5.54% Up to 70% LTV 5 year fixed £500 cashback towards legal costs for remortgages ...

Expat Residential Two year fixed product

Key Features: Rates from 6.59% Up to 90% LTV 2 year fixed Expat Residential Purchase & Remortgage Minimum loan £25,000 Maximum loan £1,500,000 Extra Information: Ex-Pat Residential LTV 85% Ex-pat BTL & Holiday Let/airbnb (we use true holiday let income) –...

Specialist BTL semi-exclusive product

Key Features: Rates from 5.29% Up to 75% LTV Loans from £250k to £2.5m 2 & 5 year fixed rates Acceptable Security HMOs up to maximum of 10 rooms Multi-unit blocks up to maximum of 10 units Single lets BTL with maximum of 10 properties on the loan ...

NEW Commercial Finance product

Key Features: Commercial investment rates from 6.39% Commercial owner occupier rates from 6.19% Purpose built student accommodation rates from 6.49% Up to 75% LTV No maximum loan amount No maximum property value Owner occupier and investment applications accepted...

SEMI-EXCLUSIVE buy-to-let specialist properties product

Key Features: Holiday Lets (Air BNB) & MUFB/HMO up to 6 rooms in Northern Ireland MUFB/HMO up to 12 rooms + Student lets in England & Wales Flats above commercial Ex local flats with deck access Semi-commercial Studio flats below 30 sqm 5 year fixed rate Up to...

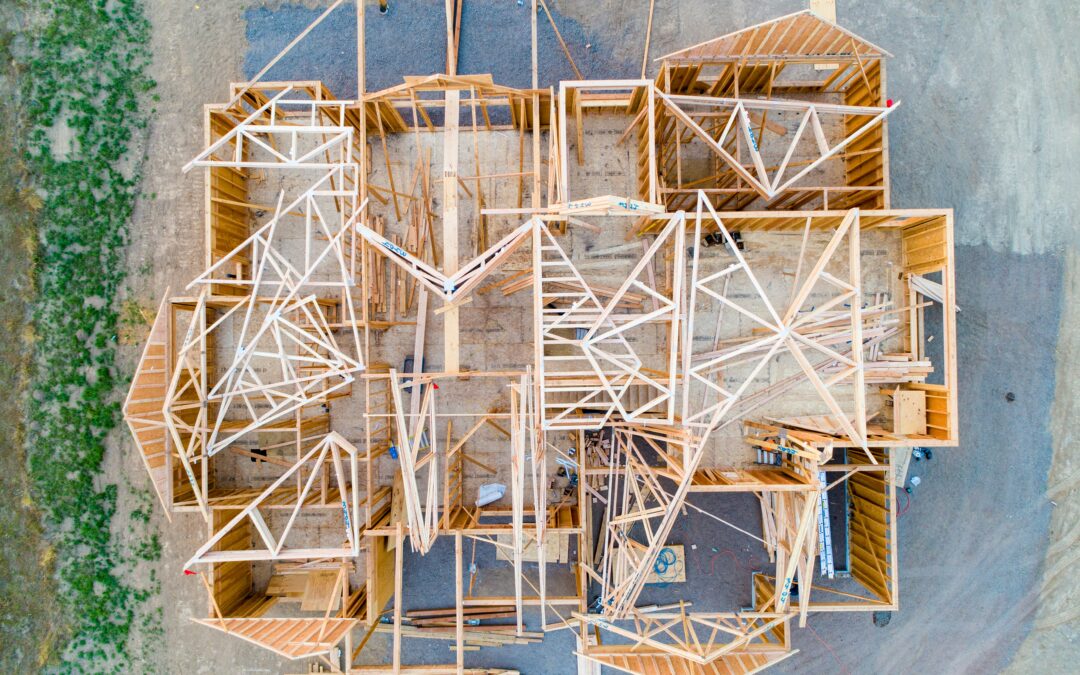

Development property insurance

Development property insurance Objective & outcome Solstar was approached by this client seeking buildings insurance for a property they were purchasing to renovate. The goal was to finalise renovations within an 8-month timeframe, before selling. Solstar promptly...

Another seamless completion assisted by Solstar

Another seamless completion assisted by Solstar Objective & outcome This client was in the final stages of completing their property transaction when a last-minute issue arose regarding insurance coverage; the buildings insurance provided did not include...

Comprehensive private health cover for you and your family

Comprehensive private health cover for you and your family.Objective & outcome Solstar recently assisted a client who faced a sudden loss of private health care when his wife departed her job who provided this. This left our client, his wife and their two children...

-

The UK Specialist Lending Podcast episode 2

-

Why finance needs menopausal women and men who get it

-

Brokers offering bridging despite lack of sector knowledge

-

Helping your clients tackle the rising cost of living

-

Removing barriers to greater bridging growth

-

Do you have the expertise that your commercial clients need?

-

The UK Specialist Lending Podcast episode 1